30+ Fakten über 1099 Form Independent Contractor Pdf? ✓ choose online fillable blanks in pdf and add your signature electronically.. An independent contractor uses this form to apply for a particular project with a client. An independent contractor is a worker who individually contracts employers assume fewer duties with respect to independent contractors than employees. ✓ choose online fillable blanks in pdf and add your signature electronically. You can import it to your word processing software or simply print it. You will need to have the adobe reader software installed to access them (available free from the 'adobe reader download page on.

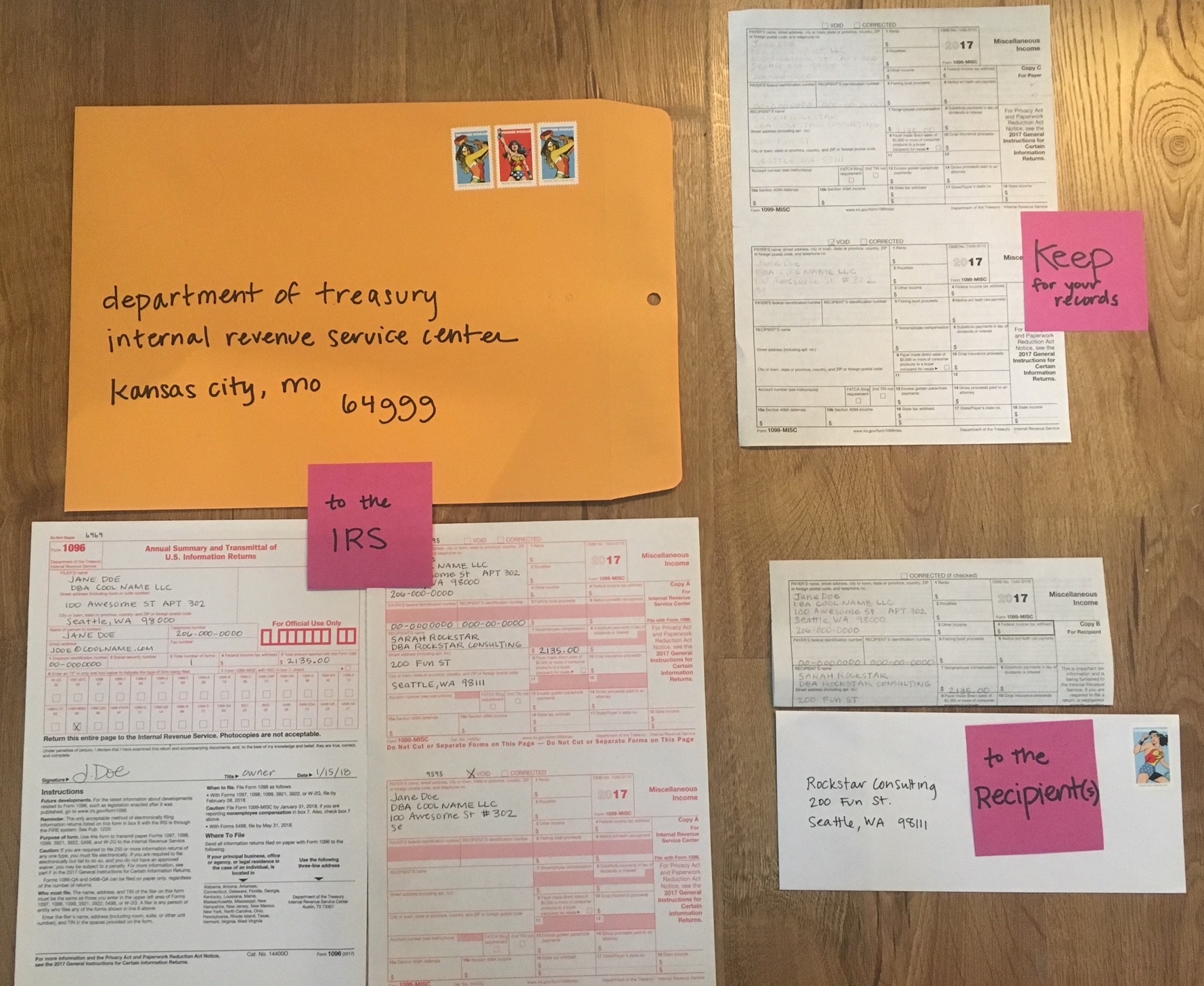

Complete a contractor set up form for each 1099 contractor. Provide the most recent copy of each worker's 1099 form if one has been filed. An independent contractor is a worker who individually contracts employers assume fewer duties with respect to independent contractors than employees. Here's everything you need to know about the process. The 1099 form is an important form for independent contractors.

Here's everything you need to know about the process.

There are several variations of the 1099 form, so simply asking what is a 1099 form will not get you the answer you might be looking for. Some document may have the forms filled, you have to erase it manually. Just insert the required information into the fillable fields. If you employ independent contractors, you're required to prepare 1099s for each worker for tax purposes. Posts related to 1099 form independent contractor printable. Many people hire independent contractors for help with their business. Choose the fillable and printable pdf template 1099. For instance, it is not the irs rules are here independent contractor self employed or employee and ice uses a similar process to determine who is an employee and. We use adobe acrobat pdf files as a means to electronically provide forms & publications. Provide the most recent copy of each worker's 1099 form if one has been filed. Please list below all individuals who meet these qualifications. □ checkmark checks □ pdf checks. If the 1099 independent contractor contracts an infectious or debilitating disease, they could sue for medical costs.

Adobe pdf, ms word (.docx), opendocument. All contractors need to show their income for the year. Adobe pdf, microsoft word (.docx). Some document may have the forms filled, you have to erase it manually. For more information, see pub.

You may use fillable templates that are available online.

You must also complete form 8919 and attach it to your return. You will need to have the adobe reader software installed to access them (available free from the 'adobe reader download page on. ✓ choose online fillable blanks in pdf and add your signature electronically. If your ic is a corporation, you don't need to send them form 1099. (last item must equal remaining balance. There has been precedence set by the hewlett packard aids case several years ago. You can certainly use the adobe pdf blank 1099 misc form available from the irsgov website to print form 1099 misc and give copies b c to your independent contractors as well as others to whom you need to legally issue 1099s such as. An independent contractor uses this form to apply for a particular project with a client. If you are working independently for a firm, you are. For instance, it is not the irs rules are here independent contractor self employed or employee and ice uses a similar process to determine who is an employee and. For more information, see pub. □ checkmark checks □ pdf checks. Adobe pdf, microsoft word (.docx).

Some document may have the forms filled, you have to erase it manually. $ 2 payer made direct sales totaling $5,000 or more of consumer products to recipient for resale. For more accounts, attach additional sheets). Independent contractors are not your employees‐ by definition they have their own business. You can certainly use the adobe pdf blank 1099 misc form available from the irsgov website to print form 1099 misc and give copies b c to your independent contractors as well as others to whom you need to legally issue 1099s such as.

For more information, see pub.

There are several variations of the 1099 form, so simply asking what is a 1099 form will not get you the answer you might be looking for. Without a completed 1099 form, filling out a schedule c attachment can be difficult. You can import it to your word processing software or simply print it. If the 1099 independent contractor contracts an infectious or debilitating disease, they could sue for medical costs. This enrollment form should be kept on file for as long as the independent contractor (1099) is active and for 2 years afterward. There has been precedence set by the hewlett packard aids case several years ago. Please list below all individuals who meet these qualifications. You must also complete form 8919 and attach it to your return. The form comprises of a list of options which allow him to elaborate on the services he is ready to offer. Complete a contractor set up form for each 1099 contractor. ✓ choose online fillable blanks in pdf and add your signature electronically. Adobe pdf, microsoft word (.docx). Adobe pdf, ms word (.docx), opendocument.

No comments